When one transaction affects multiple accounts, the amount of the accounts which are debited and credited are always equal.ĭivision of account in two parts: The basis of preparation of ledger accounts are journal and subsidiary books.

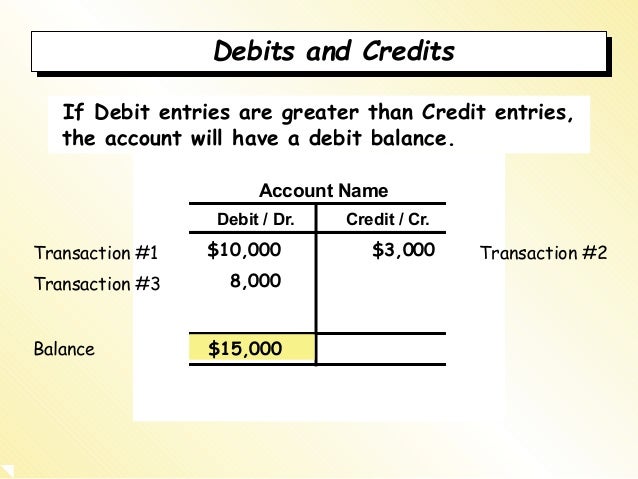

Owner’s Equity + Outsider’s Equity = Total AssetsĬapital + Liabilities = Total Assets Characteristics of Double Entry SystemĮvery transaction affects two or more accounts: In every business transaction two accounts are involved, wherein one is debited while the other is credited. Based on the Double Entry System, the accounting equation can be expressed as: Hence, for every debit, there is a corresponding credit. The system is based on the assumption that there won’t be any giving without receiving. And the account that receives the benefit is debited whereas the account that foregoes the benefit is credited.

And to keep a systematic record of the transactions, both aspects must be recorded. The system was developed by an Italian Mathematician Luca Pacioli, in the year 1494.Įach transaction has two aspects, wherein one receives the benefit while another gives away the benefit. It requires that for different transactions that have occurred during the course of business, the amount entered in the debit, of a particular account must tally with the amount entered in the credit of the corresponding account. Therefore, the transactions are entered in the financial books as regards debit and credit, wherein debit in a particular account is counterbalanced by the credit in another account. Similarly, in the field of accounting, every transaction results in an equal yet opposite balance in accounts, i.e. As in physics, every action has an equal and opposite reaction.

0 kommentar(er)

0 kommentar(er)